TYLENOL

FEEL BETTER. Competitors had reframed Tylenol's safety claim as "it's safe because it's weak." Brands like Bayer, Advil and Aleve had spent millions to make efficacy the one-and-only benefit that matters. (They all claimed that two of their pills were equal to eight Tylenol pills.) And private label "brands" were selling knock-off, look-alike pills for $9 a box less than Tylenol. Rather than fight back, Tylenol had responded to the competitive challenge by creating a multitude of new SKU's, splitting their marketing spend among 11 sub-brands, and diluting their message into a series of category-generic, look-alike, sound-alike ads. Our research revealed that safety wasn't the wrong message for Tylenol, it was just being delivered in the wrong context. Instead of being defensive on the efficacy front, we realized Tylenol needed to stop talking about the brand in relationship to other drugs, and start talking about the brand as one of the "healthier choices" people are making today. Our concept was to step outside the category one-upmanship and talk about the healthiest/safest way to stop a headache, to treat arthritis, to recover from a cold. Like massage therapy, aromatherapy, and regular exercise Tylenol might not work as fast and as long as hard-core drugs ... but when Whole Foods, POM, and Dr. Oz are among the fastest growing brands in the country, maybe hard-core drugs aren't what people want to put in their bodies.

Campaign / OOH / Social / TV / Digital Video / Website

SUMMATION VIDEO

With that in mind, we doubled-down on Tylenol's safety message ... on the fact that Tylenol works "with your body in ways other pain relievers can't," that it targets pain more precisely than other pain relievers, and eliminates pain with fewer side effects and unwanted consequences.

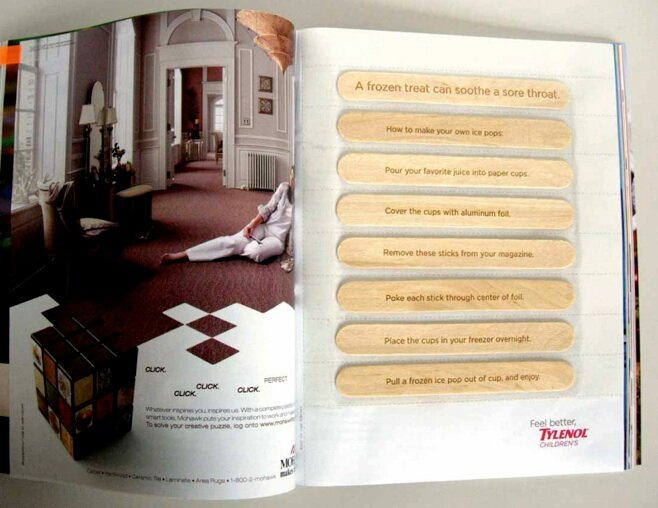

SHOW UP OUTSIDE THE ANALGESICS AISLE.

To "walk the walk" it was essential that the brand show up in people's everyday lives ... not just in the drug store, once they already had a headache or felt sick. To accomplish this, the brand used outdoor advertising to remind and encourage people to make healthy choices that could prevent sleeplessness, or headaches, or colds. We installed heated bus shelters across the east coast during the winter. We partnered with CVS in New York City to provide free cab service to and from the drugstore for people who weren't feeling well. We handed out water on hot summer days, and umbrellas on cold, rainy days.

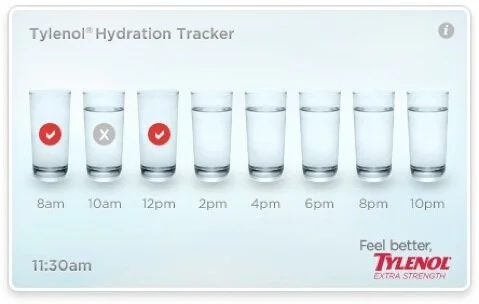

A FEEL BETTER ONLINE EXPERIENCE

To encourage healthier choices online, we created a new, simplified, non-headache-inducing tylenol.com. We created a co-op late night TV platform with Hulu so people could watch their favorite programs the next morning, instead of staying up late. And we created online reminders that popped up throughout the the day to help people hydrate, release stress, stretch, and exercise regularly.

THE RESULTS

From the first week the campaign launched, Feel Better had a dramatic effect on Tylenol’s bottom line. Prior to the launch, adult Tylenol was losing an average .37 share points per week (compared with the previous year.) Over the first three months of the campaign, adult Tylenol gained an average .36 share points per week. (To put that into context, each tenth of a share point is roughly equivalent to 2.3 million pills.) All of this happened with an 18% decrease in spending compared to the previous year, and a 53% decrease in TV GRPs.

Six months later, we launched sub-brand specific work for Tylenol PM, Extra Strength Tylenol and Tylenol Arthritis. Tylenol PM saw immediate 2% weekly increases in sales. Tylenol Arthritis sales rose 14% during the next 13 weeks. Aleve, the category leader in arthritis, saw double-digit sales losses. During 2008, Tylenol Arthritis was the only brand in the category to grow share.

That winter, we introduced Tylenol Cold Warming Liquids. Shipments of the base product exceeded forecasts by 31%. Theraflu, the only other brand with a similar product, lost share by 14.8%. Other brands with liquid cold medicines also suffered (Nyquil down 4.3%), while all Tylenol Cold sales increased 14.3%.

Validating the impact and effectiveness of the campaign’s non-traditional efforts, sales rose an additional 5.7% in markets where our experiential outdoor, and feel-better gestures ran during 2008-09. In the spring of 2009, those experiential, non-TV media investments led to an 11.2% increase in Tylenol PM consumption.

As for J&J, and its insistence on copy-testing benchmarks that require all of their commercials to score in ASI’s top 10% on both recall and persuasion, every TV spot ever tested in the campaign scored in the top 10% on persuasion, and 9 of 12 surpassed the mark in recall. The campaign proved to be the highest-scoring campaign in J&J advertising history.